Open Banking Readiness

Embed open banking into your existing technology ecosystem

The gold standard for digital banking

treXis places power back in your hands by directly integrating systems in real-time, ensuring all entitled and consented transactions are security exposed for Open Banking.

treXis Solution Approach

Empower Your User Experience with treXis

Step into the future with treXis, your foundation to owning your data like never before. Imagine having the ability to access financial data in one place, making digital banking personalized and seamless for the user. treXis leverages and implements FDX to meet the Open Banking requirements. We place control back in your hands by directly integrating systems in real-time, ensuring every transaction is at the user’s fingertips.

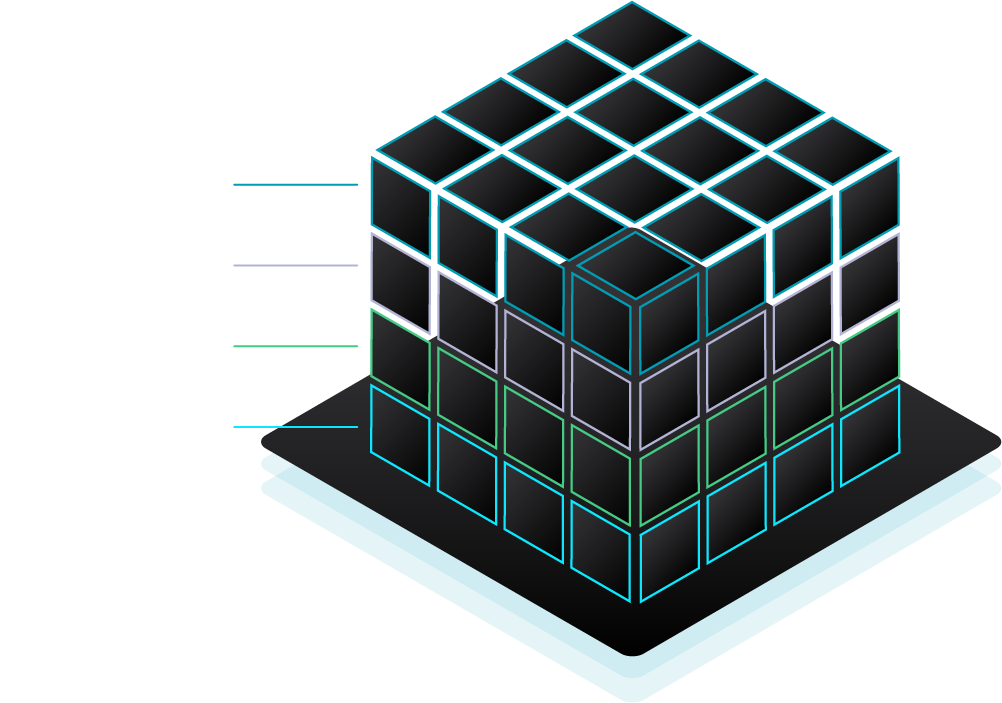

Effortless Integration and Ownership

Turn your environment’s infrastructure into a data powerhouse. treXis will lay the foundation, connecting you to an improved digital banking platform.

Secure, Enhanced, and User-Centric

By integrating the treXis data hub into your financial ecosystem, you optimize data flow, transforming how users interact with your services. The Hub’s real-time data access empowers users with immediate insights and transparent financial information from a single source, setting the gold standard for digital banking.

Seamless Support and Maintenance

Transition can be daunting, which is why we’re with you every step of the way. From intake to transition, we work closely with your team, ensuring your foundation is set and knowledge is transferred.

Use Cases

To become prepared for Open Banking, one of the standards FI’s could implement is the data model that adheres to Financial Data Exchange (FDX) standards. This widely adopted standard requires secure, permissioned access to financial data based on user consent. This approach authorizes:

01 Selective Account Linking: Open banking provides the ability for users to selectively link their accounts with third-party services. This involves exposing an API such as FDX to facilitate secure and specific access to designated accounts. Customers need the ability to safely and securely share only data that the FI or individual user granted consent too. This is a critical requirement for Open Banking compliance and secure data exchange.

02 Dynamic Consent Management: Open Banking regulations require users to manage their permissions for account data sharing with external services. This includes adding and withdrawing access to third party systems.

03 Centralized Profile Management: Open Banking enables centralized customer security profile management amongst all connected third party systems.

Problem Statement

01 How to embed open banking into an existing technology ecosystem securely.

Why treXis?

SME's You Can Trust and Rely Upon

Dedicated, supplemental resources that are committed to your success.

Accelerated Outcomes

Pre-built components ensure a solid foundation with accelerated outcomes.

Building Success, Together

We bring your vision to life with an intentional transfer of ownership, putting our Clients in control of their destiny.